Better investment advice through intelligent automation

In a world where many advisers and wealth managers are struggling with rising costs and limitations of legacy systems there is a growing pressure to provide customers with a smoother and more inituitive user experience.

“We bring smarter investment technology to financial advisers, institutions and their clients. We are creative, independent and thoroughly committed to making high quality financial advice accessible to everyone”

request a demoOur Products

PortfolioCloud operates on a Software as a Service (“SAAS”) basis and offers a number of different technology solutions for organisations either embarking on greenfield investment technology projects or enhancing existing legacy investment technology stacks. In the rapidly changing world of financial services scaling your firms existing investment and advisory IP , overseeing portfolio compliance and ensuring high quality advice levels to your end customers requires a modern and a flexible framework that will grow with your organization.

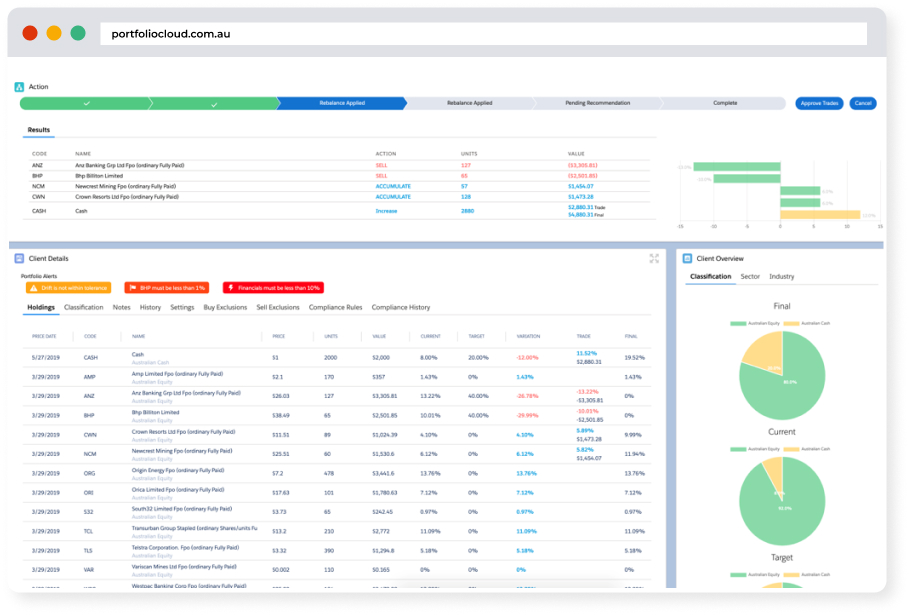

Portfolio rebalancing and management technology

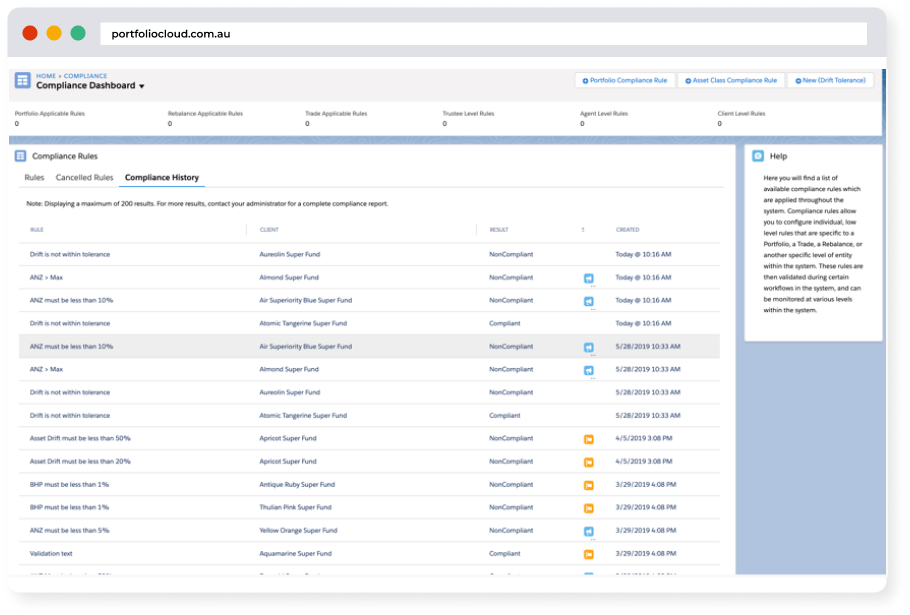

For all workflows from investment committee decisions, the application of global and client compliance rules and the ongoing pre and post trade portfolio management.

Mass portfolio customisation of models, advice and APL management

For all workflows from investment committee decisions, the application of global and client compliance rules and the ongoing pre and post trade portfolio management.

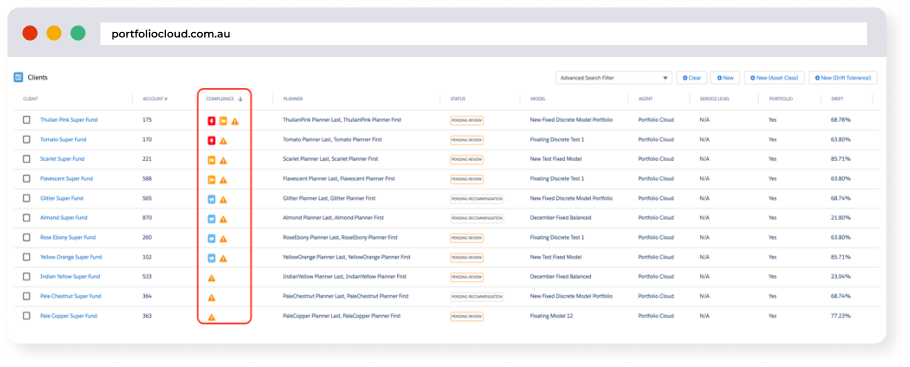

Our centralised investment dashboard for advisors, portfolio managers and compliance managers

Brings together multiple industry data sources allowing decision makers to monitor, research, track and scale all client portfolio interactions and advice. This creates a centralised environment across both discretionary and client consent models, driving productivity, client engagement and consistency in quality advice delivery.

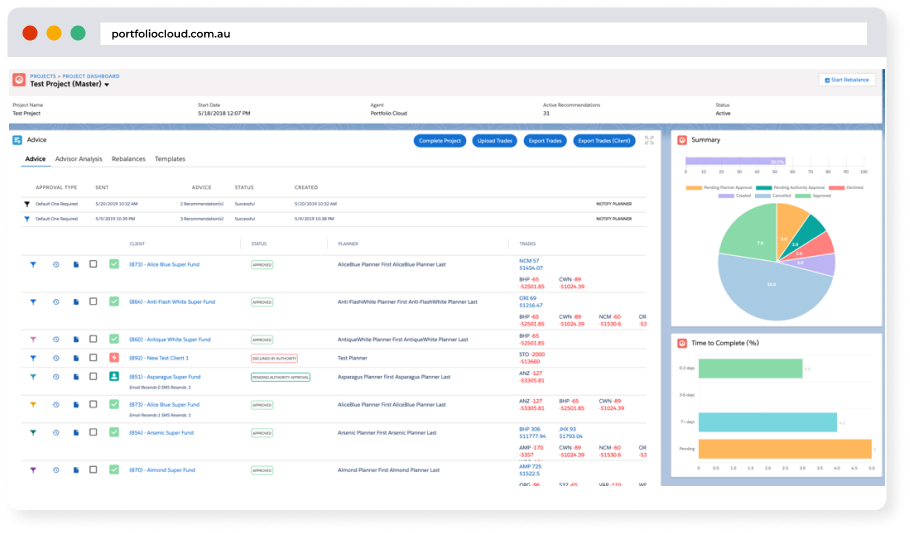

Our automated workflows in advice generation

Allows firms to scale simple and highly complex advice processes from investment idea, to acceptance, to portfolio trade messaging. All rules, permissioning, branding and services standards are set by your organsiation in an easy to use and flexible workpad.

Our API first approach allows businesses of any size to rapidy build bespoke suites of applications more easily and at a lower cost. Our API technology allows different pieces of software to communicate and share information in real time, and, as a result, businesses using PortfolIocloud can customize and control the client experience and integrate easily with other services, significantly reducing the administrative burden firms currently face.

request a demoHow We Help – With Portfolio Cloud

Organisations regain investment management and advice productivity via systematic and rules-based workflows helping advisors scale their time, processes and drive better customer outcomes. Until this point an accurate and reliable cross platform solution for portfolio management and advice delivery in financial service has been lacking.

ASX Chess based customers that traditionally have used a client consent model and want to be involved in the decision-making process with their advisor now have the ability to interact in that format via PortfolioCloud.

The open API approach has allowed asset managers, stockbrokers and financial planners to take back control of their firm’s operations, means your operational expertise remains embedded in your business and not other people’s platforms.

Deploying smart technology within your organisation that assists advisors and their clients not only provides economic benefits. PortfolioCloud provides firms with a competitive advantage in a rapidly changing industry landscape, it also helps with attracting and retaining advisers.

Internal portfolio models can be broad and incorporate ETF’s, Funds, Stocks, Fixed Interest and Alternative Assets all blending to either Asset Allocation rules or discrete single asset models based on your firms investment IP, client preferences and risk profile.

Who We Help – With Portfolio Cloud

Advisers looking to take back control of their client experience, simplify their back-office and remove reliance on their legacy providers.

Discretionary Fund Managers looking to automate their portfolio management and provide better value-add for advisers.

Digital platforms looking to upgrade their investment tool sets using a SAAS based approach.

Stockbrokers looking for a ready-made advice process which enables them to expand their service offering into holistic financial advice.

Our Technology

PortfolioClouds innovative technology framework providing a powerful and highly customizable suite of tools that automates investment process, workflows and powers innovation across your business and investment stack. PortfolioCloud is technology solution that centralises your processes without having to disrupting existing platform or CHESS relationships.

Deployed in the cloud, PortfolioCloud services deliver a scalable and high-performance environment for financial planning firms, stockbroker and large enterprises looking to scale investment technology.

Capacity grows automatically with demand, all infrastructure and containerized deployments are completely automated, allowing rapid innovation to keep pace with your changing needs.

Our infrastructure is based on Amazon Web Services' (AWS) architecture for protecting financial data. Data is protected through the use of separated AWS accounts, virtual private clouds (VPC), private subnets, and VPNs. A full history of all access and change events, both within the infrastructure and the application, is kept for governance and audit purposes.

Open Architecture

PortfolioCloud is an open infrastructure and built to support API connections. We are able to connect with administrators, trade execution platforms, ASX CHESS, investment platforms, CRM’s and Research providers. We are a centralised hub of operational and investment solutions for investment management firms.

Current Integrations

About Us

David Beggs

Co-Founder

David has over 17 years experience in the investment management industry. He recently held the position of Portfolio Manager at Metisq Capital, managing over $1 Billion in Emerging Markets equities. He also held the position of Executive Director at Halidon Asset Management, managing fixed interest and hybrid assets. David’s work revolves heavily around quantitative investment and operational processes, with a focus on the development of trading, portfolio rebalancing and portfolio management systems.

Matthew Cosier

CTO

Matthew has over 15 years’ of experience as a Software Engineer across a range of industries and disciplines. Matthew currently serves as the CTO and Co-founder of the successful Microsoft Partner, Hazaa, helping organisations realise their potential through the implementation of technology. Matthew lead the development of the Wealth.Net platform for Bluedoor technologies, who were later acquired by DST.

Mark Links

COO

Mark has over 20 years experience in Australia, UK and South Africa and has a history of scaling successful platform and advice businesses. He has held appointments as Head of Operations at Transact, the first UK open architecture platform which is now a $2b FTSE 250 company. He also held positions as CIO at Saunderson House and Operations Director at AXA Wealth Elevate platform. Mark has extensive experience in developing technology propositions and building scalable wealth management operations. Prior to this he was Managing Director at Confluent.net, a consultancy focussed on helping early stage SAAS platforms grow and expand.

John Beggs

Chairman

John was previously CEO of Metisq Capital managing Emerging Market equities. He has held appointments as the Head of Equities and Head of Global Markets at the Commonwealth Bank of Australia. While there he also managed large IT enterprises such as Australia’s largest retail stock broker CommSec. Prior to this, John was a Founding Partner and Executive Director of GMO Australia. He was also the founding Chief Executive of the Australian stock broking subsidiary of a large Japanese securities company Daiwa Securities. Before moving to Melbourne, for nine years John held academic faculty appointments at Yale University and the Australian National University. John holds a PhD in Econometrics.